Right… ![]()

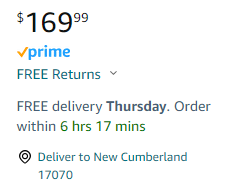

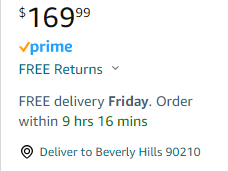

Well then there is the question of if the said transfers even exist. In many cases Amazon simply does not transfer anything and just adds time to the expected delivery date to pocket more. After all they have been doing this without the fees for over a decade.

Also right ![]()

So… ![]()

![]()

![]()

See what I mean…

It amazes me how many of our buyers on Walmart pay $14 for a product + tax (where applicable), and the $8 for shipping instead of signing up and paying to be a Walmart + member. Sometimes gets close to twice the value of the product.

It’s $98. If you’re ordering more than once per month, it pays for itself. ![]()

Another big thing to keep in mind here is, Amazon’s not forcing these fees onto anybody. Nobody has to use FBA. Can’t be competitive with FBM? Nobody has to be an Amazon seller. Most of the FTC’s wins are related to deceptive or illegal advertising or business practices that scams consumers. A convoluted fee structure designed to unwittingly charge consumers more money would be illegal. Sellers are not consumers though, and business owners are expected to be able to figure out their costs even if it’s presented in a way that’s hard to understand (including if that presentation is intentional).

Bottom line is, everybody paying the higher inbound costs is doing so because they want to. If they didn’t want to pay the costs, they just wouldn’t send the shipment, simple. If someone’s in a position where they can’t exit Amazon without going bankrupt and the new fee structure doesn’t work for them, then that’s because of (poor) business decisions they made in the past. FWIW, I’m 100% Amazon and would go bankrupt if I tried to exit, but I almost always get in front of changes and prepare for them before they happen. I am working towards making enough to exit Amazon permanently. My end goal is not to be an Amazon seller forever, and that really shouldn’t be anyone’s end goal. If it is, you might want to be best buds with a cardiologist and maybe a psychiatrist.

Complaining about costs going up does nothing except maybe make one feel better for a little while (which I guess is a valid reason to do so), but isn’t going to change anything.

Is the rollout of these changes a mess? Yes, but what major change has Amazon ever rolled out without a major mess? Look at how big of a mess the INFORM act implementation was. People were getting suspended over that. Arbitration is also an option if someone feels that Amazon has done something illegal, or has breached the contract. In the case of inbound costs, I don’t think any seller has a case to make that anything illegal has occurred.

Yes, but Amazon has way more affected Sellers than Walmart. That doesn’t mean that there aren’t many affected Walmart Sellers, but it’s less of an optics/PR move than a simple efficiency move: If you can settle some precedent on the biggest of all the big fish, the rest of the big fish have less fight in them.

Ultimately, this is where the FTC has some investigative obligation:

Last week, Amazon sellers told Fortune that at least one of the new fees—called “the inbound placement service fee”—appears designed to pressure merchants to utilize another Amazon warehousing service in addition to FBA, called AWD, or Amazon Warehousing and Distribution. The idea of AWD is to replace warehouses where Amazon sellers store their long-term inventory before they are shipped to Amazon’s FBA warehouses or fulfillment centers to be packed into customer orders.

…

Beyond the new inbound placement fees, on April 1 Amazon will also begin charging most sellers a fee if they don’t consistently have four weeks of inventory in Amazon fulfillment centers. One problem, sellers told Fortune, is that Amazon also charges sellers for storing too much inventory in Amazon facilities.“You gotta precisely thread the needle to not get completely killed,” Judah Bergman, the CEO of a major Amazon seller called Jool Baby, said last week of the low-inventory charges.

However, sellers can avoid the low-inventory fees by handing Amazon more control of their supply chain and utilizing the AWD service for long-term inventory storage.

The previous Fortune article that got the FTC interested is discussed in @Pepper_Thine_Angus topic here: [Fortune] Inbound, outbound, and low inventory fees.

They’re definitely pressuring people to use AWD. I know that “bundling” of products/services in certain ways is illegal (Microsoft Windows/Internet explorer was a big deal). But that was a different case as the Windows OS had far more power than the Amazon marketplace (for example, any job that used a computer most likely made it mandatory that you use Windows), and one of the key arguments was that it was hurting consumers.

Amazon pressures sellers to use FBA by giving perks, and that isn’t illegal (though the FTC may be trying to make that argument now), so I don’t see why pressuring FBA sellers to use AWD by giving FBA perks would be illegal.

It might not be, but that’s what an investigation is for. And all this is, is an investigation. The FTC is obligated to investigate.

Plus this that does directly involve non-Seller customers:

Some of the business owners who spoke to Fortune also said that this new “placement fee,” coupled with another that Amazon will soon charge for low-inventory levels, will force them to pass on price increases to Amazon customers.

Well, saying that Amazon is liable for a 3rd party seller’s price increases is a little bit thin, considering that businesses raise prices all the time due to costs increasing in 1 way or another. If a seller is making their Amazon prices higher than off-Amazon prices, Amazon already protects customers by removing the buy box (and search suppressing) for those offers.

I think the end result here is they’ll investigate, they’ll maybe tack on some additional allegations to the lawsuit they already got going, things will drag in court for a couple years (during which nothing happens of course), and there’ll be some settlement where not much really happens but the FTC will try to play it off like they got some huge concession and try to call it a win.

It could also be asserted that the fees are egregious and opportunistic made only possible by the scale of Amazon’s operations. No different than railroads and Standard oil.

Amazon has operated at a profit recently doing the exact same thing, and this change is only possible based on the market capacity of Amazon’s logistic capacity.

Amazon vendors are also not being required to split shipments so making an assertion Amazon does not already or will not continue to have internal distribution with or without the fees is kind of moot.

Companies routinely give favorable treatment to other bigger companies while screwing over the little guy. That’s why Walmart was able to knock out all the mom and pop shops so easily, they have the scale to get good deals from all the suppliers who charged the mom and pop shops so much more. I’ve been on the management side of a convenience store. A lot of times it was cheaper to go buy a bunch of crap that was on sale at the grocery store than to buy the same stuff through the official distributor because companies like coca cola and frito lays give national chains all kinds of sales deals that they never give to small shops.

We are/were a larger seller than we were/are a vendor. We have several corporations and the seller one is now much larger than the vendor one and no such benefit was ever in play. Not even a PO change for shipments. Same recieve center as it always has been for years ONT8 , while FBA gets ONT, SMF, PHX, LAX, SCK, LAS and GYR.

2 pallets a month for vendor, 20-30 pallets a month for FBA. Not saying your assertion is wrong, just saying its not demonstrable in our case.

That’s because some genius in Seattle thought this was going to be great and make the company more efficient and profitable. A great use of the space their overbuilt is what they were thinking.

Then, in typical Amazon fashion, they blew it. Horribly executed, sellers got to talking about it, and very few people use it. I don’t think there’s a seller here that uses it.

So this is Amazon’s way of trying to force us to use the thing that cost lots of money and is just basically sitting on the shelf.

And if they want to push sellers into AWD, then they better think about the hundreds of thousands, if not millions of listings that are banned from using it - shelf life - no matter how long…

Definitely the exception here. For the most part the average vendor is bigger than the average seller central account, and we all know how Amazon loves 1 size fits all.

Vendors also play by completely different rules and they cede a lot of control (for important things like pricing) over to Amazon so it’s not that surprising they’re less hassled on other things.

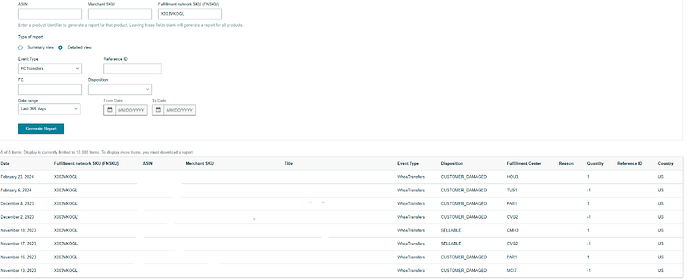

But we can see which FCs are sent what via the inventory ledger, are you claiming that this information is fraudulent / false / fabricated?

I believe what he is saying is his oversized goods are sent directly to the FC where they will stay and ship from to buyers. No transfers, ever, yet being charged a placement fee meant to fund the labor / freight of moving stuff around that will never move and Amazon knows it.

So yea:

@packetfire this sums up exactly what I tried to say. ![]()

Here is a fertilizer tank we offer for sale that is oversize. Each transfer listed is a returned item being moved to get back to us as part of a return. We sold ~200 last year. Not a single unit was moved from one FC to another for sale to a consumer.

We paid the return processing fees and return shipment fees on all of these.

Yet…

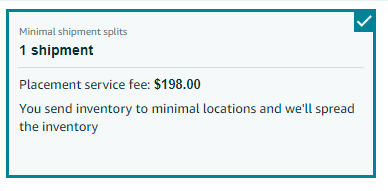

15 fit on a pallet, so one pallet a month is about a years worth of sales meaning we can’t split shipments much. This means a $13.20 price increase in logistics costs for no reason AND we still have to ship across the Rocky Mountains to make life better for Amazon.

If they said, “We are going to charge this fee so you can ship from Anaheim to San Bernadino” that would be fair, but no, they still pick destinations across the country, then ship the product from that one singular location like they did for the previous decade.

You have a documented fraud case. The FTC would be interested in your data.

Well I don’t have one yet, because as my co worker pointed out, we have no way to know if they will transfer the new shipments around under the new program until we ship stuff in again, which we have not done for oversize yet. We like many others, sent in a wall of stuff to avoid this on the 1st.

My previous assertions are only based on our inventory and sales history. I would need to wait another ~60-120 days to make a true data set with the current program.