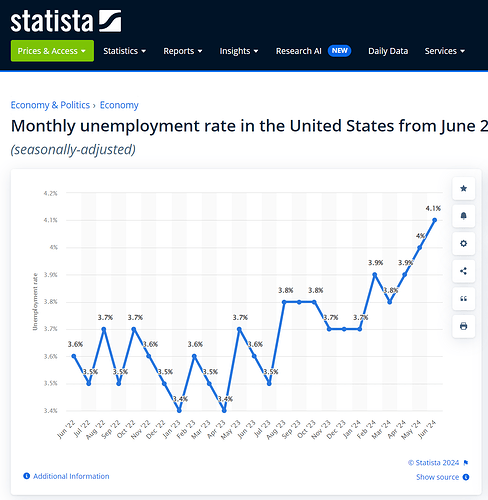

Consumer buying power is at a 40 year low. Wages have not kept pace with prices.

Whether the economy is getting worse or not, many households are feeling like it is,

Further complicating matters is some major corporations are increasing their profit margins greater than the rate of inflation. Those companies are making higher profits on lower sales and sales revenues.

I often refer to this state of affairs as “hard times” because that is a term not subject to the prejudices of government agencies and economists.

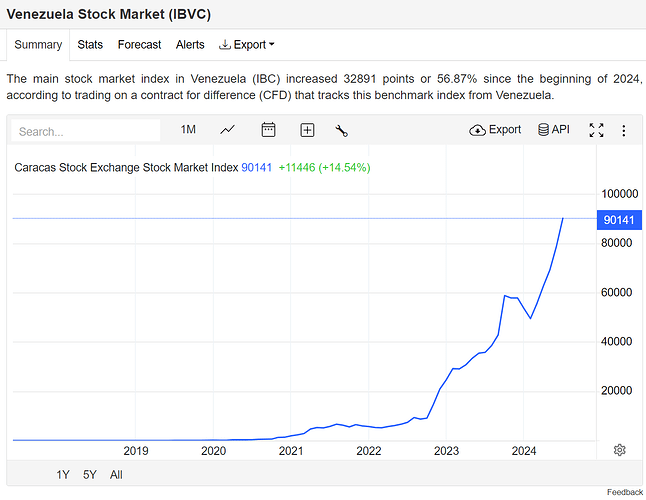

For a portion of the population, who are invested in the casino known as the stock market, these are great times. The profits from the financial services industry affect the numbers that economists base their opinions on.

Since I sell useless items to people who have money, my online business only has problems with the items I sell to people with limited funds.

And of course, I do not sell any cheap Chinese crud. But I buy some for my own use, and the Chinese economy is worse off than ours, so prices are down.

Years ago, when Taiwan was the source of many cheap imports. I wanted to private label product for my computer business. I got quotes from Taiwanese suppliers. The landed cost of product was higher than what I could pay in the US to large importers from Taiwan.

I developed a relationship with an importer in NYC and got faster delivery at lower cost with a level of consistency you might not get today from some jobber selling on Alibaba.

I suspect there are still some big importers who one could seek out and deal with.

A big problem with imported goods is the lack of any real relationship with or knowledge of your suppliers. The people I know who have had success with imported goods have an employees or a relative in the country the product comes from.